Risk management is a crucial aspect of any business or project, focusing on identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, control, and monitor the impact of these risks. While many strategies and practices are employed to manage risk effectively, it’s equally important to recognize what does not fall under risk management strategies. Understanding these distinctions can help organizations streamline their efforts and focus on effective risk management practices.

Key Risk Management Strategies

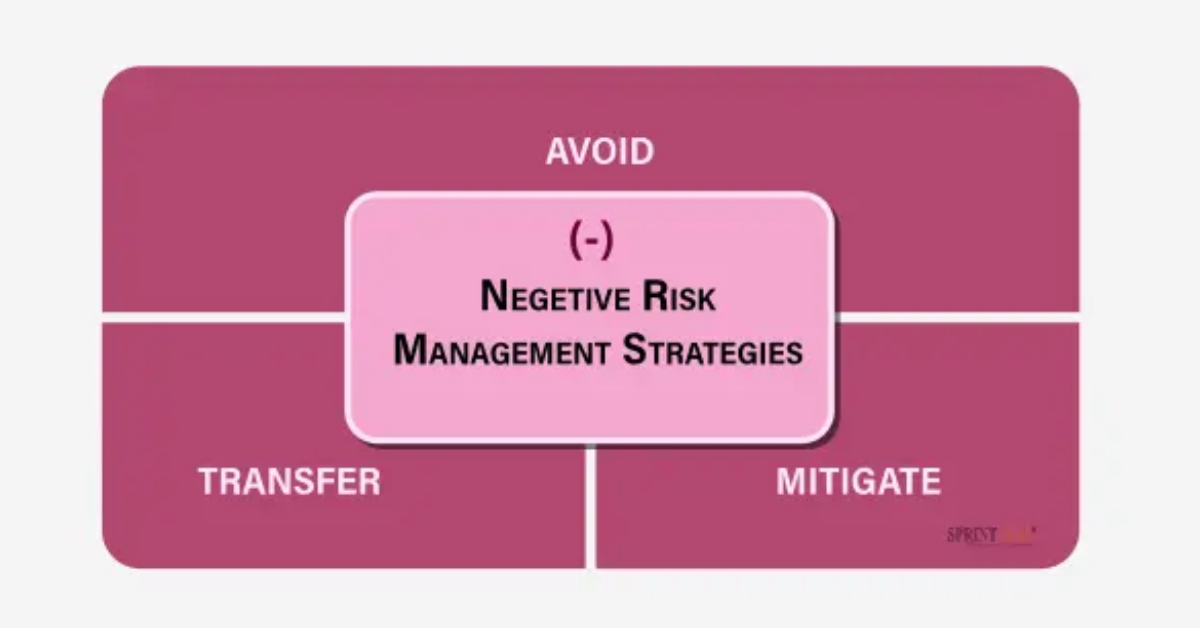

Before delving into what is not considered a risk management strategy, let’s briefly review some of the commonly employed strategies:

- Avoidance: This strategy involves changing plans to sidestep potential risks. For example, a company may decide not to enter a market that poses significant regulatory risks.

- Mitigation: This involves taking steps to reduce the impact or likelihood of risks. For instance, implementing safety protocols in a manufacturing plant to reduce the risk of accidents.

- Transfer: In this strategy, the risk is transferred to a third party. An example is purchasing insurance to cover potential financial losses.

- Acceptance: Sometimes, risks are acknowledged but not actively managed. This strategy is often used when the costs of mitigation outweigh the potential losses.

What Is Not a Risk Management Strategy?

Now that we have a foundational understanding of risk management strategies, let’s explore some common practices or concepts that do not qualify as risk management strategies:

1. Ignoring Risks

One of the most fundamental mistakes is to ignore potential risks altogether. Organizations that choose to overlook risks are not employing any form of risk management strategy. This passive approach can lead to severe consequences, including financial losses, reputational damage, and operational disruptions.

2. Bureaucratic Processes

While documentation and processes are vital in risk management, having overly complex bureaucratic procedures without a clear connection to risk management goals does not constitute a strategy. Excessive paperwork and red tape can impede decision-making and slow down the organization’s ability to respond to emerging risks.

3. Reactive Measures

Responding to risks only after they have manifested is not an effective risk management strategy. For example, if a company only addresses cybersecurity threats after a data breach occurs, it is reacting rather than proactively managing risk. Effective risk management involves anticipation and preparation, not just reaction.

4. Lack of Training and Awareness

Simply having a risk management plan in place is insufficient if employees are not trained or aware of it. An organization without proper training programs or awareness campaigns regarding risk management practices does not effectively engage in risk management strategies. Employee involvement is critical for successful risk management.

5. Financial Projections Without Context

While financial projections can inform risk management, they do not themselves represent a risk management strategy. Projections need to be analyzed in the context of potential risks, including market volatility, economic changes, and unforeseen events. Without this context, financial projections are merely numbers that lack strategic relevance.

6. Inadequate Communication

Effective risk management relies on clear communication channels. Organizations that do not facilitate open communication regarding risks—whether through team meetings, reports, or collaborative tools—fail to implement a proper risk management strategy. Lack of communication can result in misunderstandings and missed opportunities for risk identification and mitigation.